Crossing the Chasm: How Stablecoins Are Taking Over Global Finance

Regulations, Competition, and the Road to a Trillion-Dollar Market

2024 marked the year stablecoins became undeniable, backed by evolving regulatory laws and TradFi giants jumping in head first. Over the next half-decade, these tokens are going to hit trillion-dollar territory, reap massive yields, and crown their own winners. Let’s map out the regulatory, economic, and competitive factors driving this revolution.

Wall Street Embraces Stablecoins

Let’s break down how we crossed the chasm. There are two main drivers here - traditional finance adoption, and regulatory acceptance.

Traditional Finance Adoption

Bank of America - Announced it will launch a stablecoin once it’s legally approved in the USA.

Visa - Launched VTAP - a platform designed to help banks launch their own fiat-backed stablecoins.

Stripe - Committed to going all in on crypto in its 2024 annual letter, highlighted by the $1.1 billion acquisition of bridge.xyz.

Paypal - Successfully launched its stablecoin, PYUSD, now surpassing $700 million in market cap as of March 2025.

Robinhood and Kraken - Teamed up to issue the USDG stablecoin.

Regulatory Acceptance

USA - The GENIUS Act and the STABLE Act are under review in the Senate and House; its likely one of them will pass around August 2025. US regulation will be the single biggest driver for stablecoin growth in the coming years.

EU - Adopted the MiCA Regulation in June 2024.

Singapore - Implemented a dedicated stablecoin framework in 2023.

Dubai - Officially recognized its first stablecoins (USDC and EURC) in February 2025.

The Overton Window has shifted: stablecoins are now a consensus choice among traditional finance firms, and regulators are putting fair laws in place. These institutions act as the pragmatist gatekeepers—now that they’re on board, stablecoins can expand to the next wave of adopters.

Market Leaders and Profitability: A Closer Look at Stablecoins

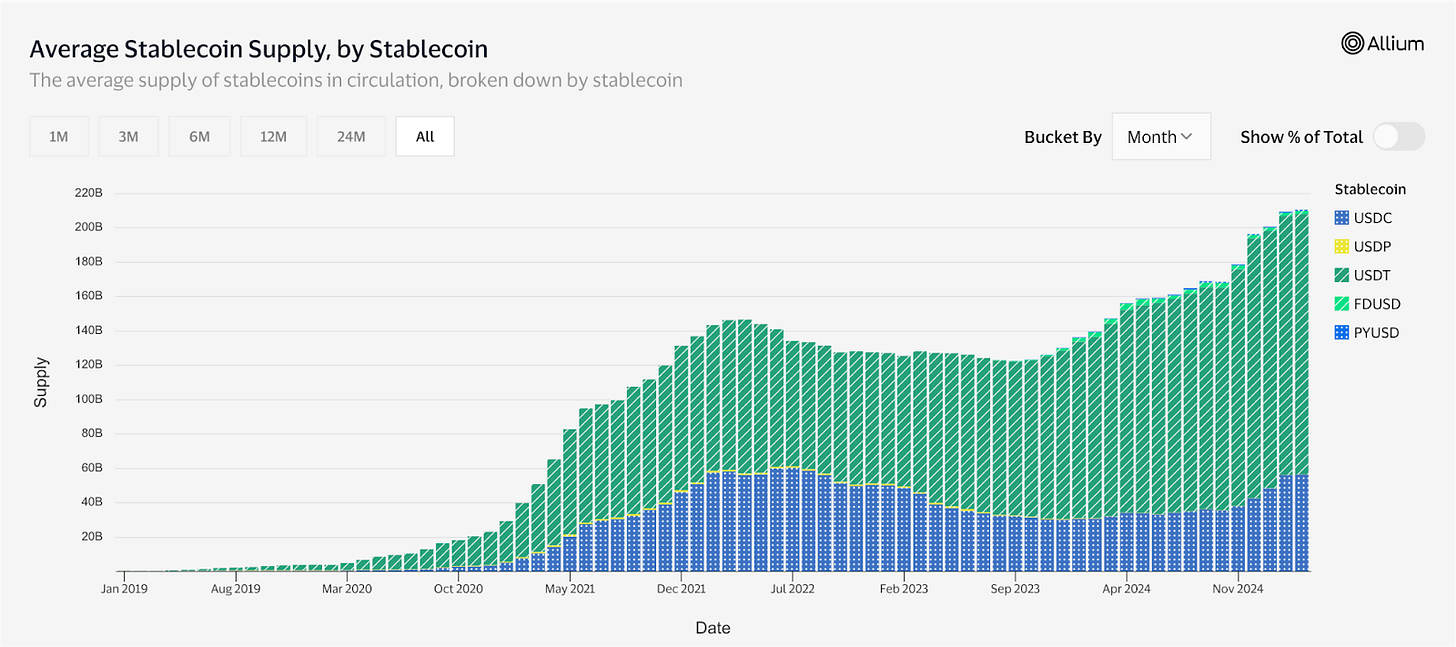

For this section, we’ll narrow our focus to USDT and USDC. Together, these two giants control roughly 90% of the market cap, making them the clearest lens through which to examine current trends in stablecoin growth and profitability.

Tether (USDT)

USDT is a true heavyweight. In 2024 alone, it generated over 13 billion in profit—an extraordinary figure given Tether’s relatively modest assets under management. For context, JP Morgan earned about $58 billion in profit on roughly $3 trillion in AUM. That’s nearly 470% more profit per dollar for Tether.

Today, Tether’s market cap sits above $143 billion, and it holds more U.S. Treasuries than nations like Germany and Mexico. Notably, Tether’s profit stems from both treasury yields and its Bitcoin holdings, the latter proving particularly lucrative in 2024.

Circle (USDC)

Although smaller than Tether, USDC thrived in 2024, reaching a market cap of $57 billion. While Circle hasn’t disclosed its exact profits, estimates based on its AUM and known treasury yields suggest earnings of $1–2 billion. Because Circle hasn’t announced any crypto holdings, it didn’t benefit from Bitcoin’s surge in 2024 the way Tether did.

In terms of adoption, USDC remains the go-to choice for U.S. institutions and larger DeFi transactions. Meanwhile, Tether is favoured globally, particularly for smaller transactions and in countries outside the western banking system.

Stablecoin Growth - 5 Years

Stablecoins, with their open and programmable nature, are arguably the most powerful payment technology in existence. Their flexibility positions them to become the primary mode of transferring value across both developed and emerging markets. To gauge just how far they can go, we’ll compare stablecoins against the US Treasury market, the M2 money supply, and total bank deposits.

Total Market Cap of Stablecoins

First, let’s focus on Tether and Circles asset distribution:

Tether Asset Distribution - Dec 31st 2024 (Link)

82.3% - US Treasury Bills, Repo Agreements, Money Market Funds

5.7% - Secured Loans

5.5% - Bitcoin

3.7% - Precious Metals

2.8% Other

Circle Asset Distribution - Dec 31st 2024 (Link)

85% - US Treasury Bills, Repo Agreements

15% - Cash held at banks

As of March 2025, combined they have about $200 billion in total market cap. Let’s now compare this to the treasury market at large.

Treasury Market

Stablecoins often rely on short-term treasuries—much like Money Market Funds (MMFs)—so it’s useful to assess the size of that market to gauge potential growth. Here are the key figures:

$28.6 trillion in total marketable U.S. securities (both long- and short-term)

$6.4 trillion in T-bills (maturing in under a year) as of February 28, 2025—a full 22.4% of the treasury market

Most countries hold less than 15% of their treasuries in T-bills, favouring longer maturities

Money Market Funds, holding over $7 trillion, remain the largest purchasers of short-term treasuries

At $200 billion, USDT and USDC together already represent 3.1% of the short-term U.S. Treasury market.

M2 Money Supply

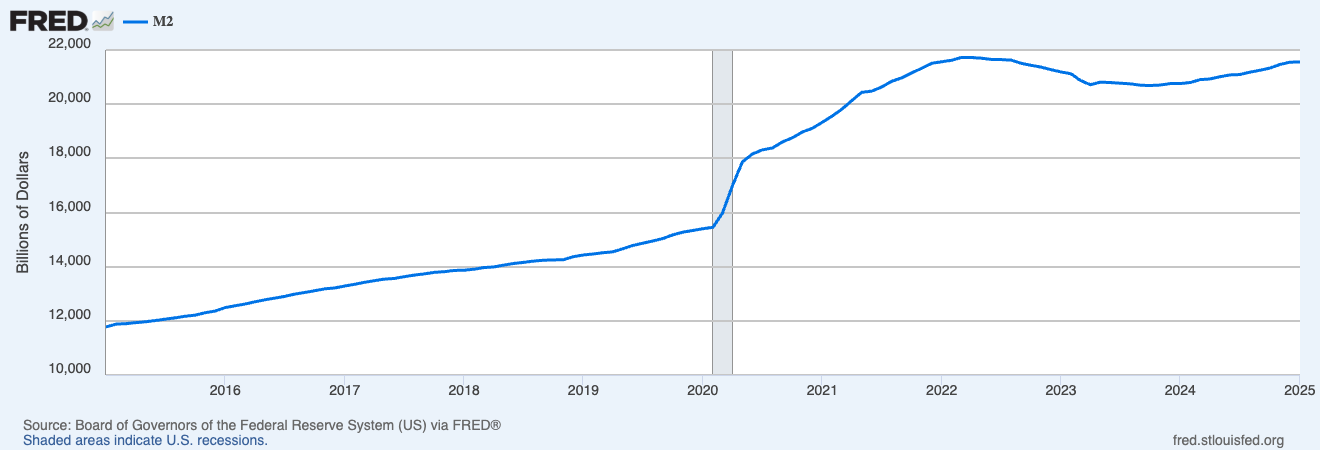

Unlike Money Market Funds, stablecoins are fully liquid and spendable—similar to a checking account. This makes the size of the U.S. M2 money supply a useful benchmark for gauging how many stablecoins could potentially circulate.

Currently, the M2 supply stands at $21.5 trillion, which makes a $200 billion stablecoin market roughly 1% of the total.

Compared to Largest Banks

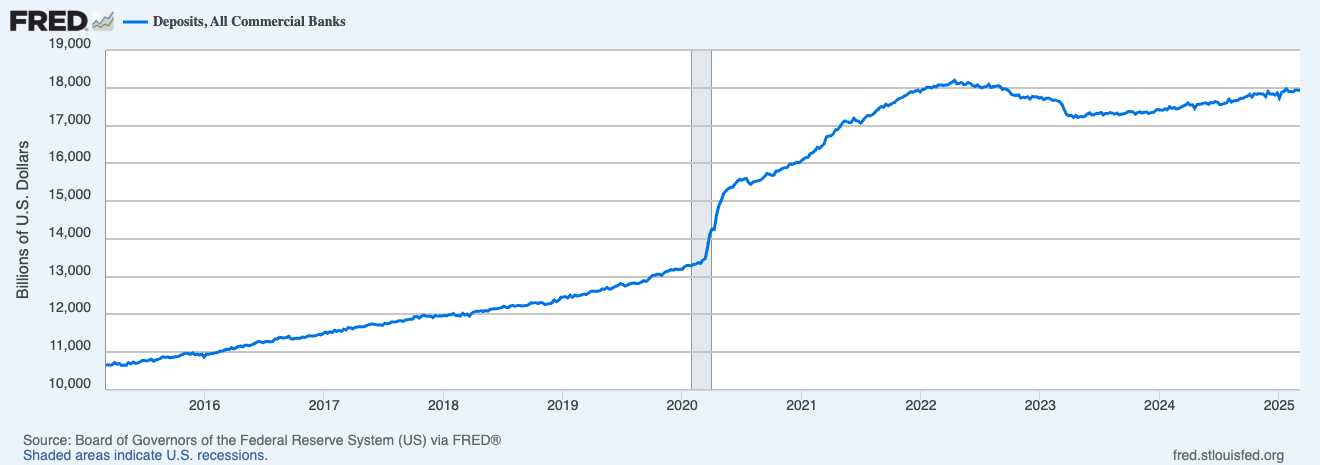

Because stablecoins function much like traditional bank deposits, comparing them to total bank deposits offers a useful upper bound. For instance, U.S. banks collectively hold around $18 trillion in deposits, with JPMorgan alone managing over $2 trillion—giving us a sense of the potential scale stablecoins could reach.

Projecting a Five-Year Stablecoin Market Cap

Right now, the stablecoin market hovers around $200 billion, which makes it:

3.1% of the $6.4 trillion short-term Treasury market

1% of the $21 trillion M2 money supply

10% of the top single bank deposit base ($2 trillion at JPMorgan)

1% of the $18 trillion total in U.S. bank deposits

Growth will hinge on regulatory clarity—especially if the GENIUS or STABLE Act passes—allowing stablecoins to compete more directly with consumer banks for deposits. Assuming a 25% increase in M2 and treasuries over the next five years, stablecoins could feasibly reach 10–15% of the short-term Treasury market ($800 billion to $1.2 trillion) or about 5% of total U.S. bank deposits (roughly $1.125 trillion).

Both measures converge near $1 trillion—a target that will likely become a key focal point for the industry. Naturally, there’s at least a ±20% margin of error in these estimates, but the overall trajectory remains clear.

Expanding Stablecoins Beyond Treasuries

Crypto, Loans, and Precious Metals as Growth Catalysts

Hitting the $1 trillion mark would put stablecoins on par with Japan and China as some of the largest holders of U.S. Treasuries. But stablecoin issuers are likely to aim even higher. Tether’s balance sheet already demonstrates a shift beyond cash and treasuries:

5.7% – Secured Loans

5.5% – Bitcoin

3.7% – Precious Metals

That’s about 15% in alternative assets, a strategy that allows for a larger market cap and potentially stronger competitive positioning. If other issuers follow Tether’s lead, stablecoins could reach $1.15 trillion in the next five years.

Decentralized Stablecoins

Decentralized stablecoins—including MakerDAO’s DAI/USDS and Ethena’s USDe—currently hold a combined market cap of about $13 billion, accounting for roughly 6% of the entire stablecoin market.

Their higher risk profile stems from several factors. First, their collateral includes a higher proportion of crypto assets, which are inherently volatile. Second, smart contract vulnerabilities can pose additional threats, given the complex nature of on-chain protocols. Nevertheless, these projects attract users by offering higher yields and a fully decentralized experience.

MakerDAO (as of March 21, 2025):

~50% other stablecoins (mostly USDC)

~30% crypto (primarily ETH, stETH, and wrapped BTC)

~15% RWAs (treasuries and other cash-like instruments)

Ethena (as of March 21, 2025):

~58% other stablecoins

~25% BTC

~16.5% ETH and staked ETH derivatives

~0.5% SOL

Looking ahead, decentralized stablecoins could add at least another 6% to the overall market, pushing the total stablecoin cap to around $1.22 trillion in five years.

Projecting Future Revenue

If the total stablecoin supply grows to $1.22 trillion, returns on the underlying U.S. Treasuries could range from 2–5%, translating to $24–61 billion in potential annual revenue. However, whether stablecoins like USDT or USDC retain all that yield—or share it with holders—depends on whether they evolve more like money market funds (MMFs) or traditional bank deposits.

For context, treasury MMFs typically charge fees of 0.10–0.15% (e.g., Vanguard’s VMFXX with $344 billion in assets). Yet those funds aren’t freely spendable and must comply with strict KYC requirements because they’re classified as securities. By contrast, USDT and USDC function more like checking accounts—fully spendable—so they’re unlikely to offer yield. In simplest terms:

If you can spend it, you won’t earn yield.

If you lock it up or stake it, it becomes an investment, and you can earn yield.

Tokenized MMFs like BUIDL, BENJI, OUSG, and USDY already exist as KYC-compliant alternatives to traditional MMFs—rather than replacements for stablecoins. Meanwhile, decentralized stablecoins (e.g., DAI / USDS) face fewer regulatory barriers, allowing them to offer staking returns. By locking up USDS, you receive “sUSDS”—less liquid but still freely tradable—thereby providing a potentially higher yield for those willing to accept the extra risk.

Contenders and Competition: Which Stablecoins Will Dominate the Landscape?

USDC and USDT

As the leading stablecoins, USDC and USDT hold a commanding lead. They already combine for most of the market’s liquidity and adoption, buoyed by strong network effects. Unless they face significant regulatory or reputational setbacks, they’re likely to maintain 80%+ of the total market cap.

DAI / USDS and USDe

The top decentralized stablecoins—DAI/USDS and Ethena’s USDe—will not overtake USDC or USDT, given collateral constraints and operational complexity. For instance, DAI relies heavily on USDC as backing, limiting its true decentralization. Still, these protocols carve out a niche thanks to higher yields and diversified collateral, likely sustaining 5–10% of overall market share.

Paypal - PYUSD

PayPal’s PYUSD shows genuine promise, already reaching a $770 million market cap. With PayPal’s extensive fintech experience and Venmo user base, PYUSD could see significant growth if it aggressively pursues adoption. Yet it must scale rapidly to compete with the deep liquidity and trust enjoyed by USDC and USDT.

Global Stablecoin Network - USDG

A newcomer to watch is USDG, issued by Paxos in collaboration with Robinhood and Kraken. The model allows partners to post collateral, mint USDG, and earn 100% of the yield—providing a compliant alternative for companies that do not have the resources or capital to launch their own stablecoin. Its success depends on how many institutions opt into the network.

Apple and Google

Apple and Google remain dark horses in the stablecoin space. With Apple Pay and Google Pay, they could bypass Visa, Mastercard, and even banks by issuing their own branded tokens—backed by deep cash reserves and extensive user trust. However, regulators might see such a move as an anti-competitive power grab and refuse to grant permission.

JP Morgan and Bank of America

Major U.S. banks come with massive distribution channels and deep capital. A stablecoin launch from a bank of this scale could gain immediate traction. Still, banks often move slower than fintech upstarts, and their products can feel fragmented. It’s unclear if they can quickly match the user experience and global accessibility of established stablecoins.

Conclusion

Stablecoins have crossed a pivotal threshold, backed by clear adoption, substantial growth, and lucrative revenue opportunities. Over the next five years and beyond, the market will surpass $1.22 trillion, embracing new users worldwide and integrating billions of dollars in untapped payment volume. This surge is set to reinforce the U.S. dollar’s status as a global reserve currency by offering almost permissionless access to U.S. Treasuries.

Making any prediction five years out is a gamble, but let’s peek into the crystal ball of stablecoin competition anyway:

Tether gets full permission to operate in the USA.

USDC and USDT together will hold 60–70% of the market.

Decentralized stablecoins—led by USDe and USDS—capture 5–10%, but lack the robust network effects of the top two.

One fintech coin (e.g., PYUSD, USDG) could claim 5–10%, given the right growth trajectory.

Banks may control 10–20%, but their fragmented offerings and weaker user experience will limit wider adoption; they’ll rely heavily on their existing customer distribution.

All other stablecoins remain under 1%, with minimal impact.

Apple and Google will not be granted permission to launch stablecoins.

For anyone in traditional finance, now is the time to embrace stablecoins. And if you’re an entrepreneur, consider the many open lanes—forex, payroll, custody, merchant solutions, cross-border settlement, remittances, or tax applications. There are a couple of billion dollar ideas in there!

Excellent Stablecoin Data and References

rwa.xyz - RWA.xyz

Stablecoins - The first killer app - Standard Chartered

STABLE Act - US House of Representatives

GENIUS Act - US Congress

Stablecoins - The Emerging Market Story - Sept 2024 - Castle Island Ventures

Sky / Maker DAO Dashboard - By Block Analytica