Open Finance is the Fucking Future!

Real World Assets (RWAs) is a dumb name; DeFi is limited in it's scale; Let's call it Open Finance

There is no industry more soulless than retail banking right now. The customer service is the most terrible thing you can experience. Worse than a Sriracha enema.

When you are in the unfortunate position that you must visit a branch, you can smell the stagnation and boredom. The tellers and managers have no real power to help you; they’re essentially there for people who don’t use internet banking—which, for the most part, is older folks.

If you call their customer service line, you’ll be stuck in phone tag—shuffled from department to department by employees who have no clue how to help.

Why does it suck so bad? Because the entire banking industry thrives on fragmentation and siloed information. Once they’ve got you, it’s absurdly difficult to leave. The system is built to screw you.

Luckily, blockchain tech is going to save us from this dumpster fire. Trillions in financial services revenue are moving into “Open Finance.” The term doesn’t get the same hype as Decentralized Finance (DeFi) or Real World Assets (RWAs), but it’s far better.

I will argue this all below.

Everything is DeFi…… NOT!

DeFi, just works. You don’t need customer service when the technology just works with the click of a button. And I was a die hard DeFi maxi for the last 4 years. I believed Everything is DeFi.

I thought we could replace all the bankers with decentralized protocols that run on their own, with low fees and no middle men. But Trump eventually learned, Everything is not Computer, and I eventually learned Everything is not DeFi.

It’s good to have ideological views, and believe in a world where we can take away financial power from the elites. But it’s not realistic. Finance is backed by the strength of countries, which control armies, wars, and the economy. Finance runs on top of the stability that our countries provide us.

Even with our reliance on our countries, the main limiting factor for DeFi growth is the fact that you cannot recover your funds if you get hacked. Which is by design. It functions like gold or cash. All the power to you, if you self custody your assets, but if you get robbed, that shit ain’t coming back.

Today, decentralized stablecoins equate to ~6% of the total stablecoin marketcap. Modest, but still significant. Long term, I don’t believe DeFi will reach more than 10% of the total crypto market cap. And on the level of total assets worldwide, I don’t think it will ever surpass 1-2%.

But, I don’t want to downplay this! Having 1-2% of global liquidity is equivalent to trillions of dollars. This is more than enough! We need it as an escape hatch for countries that punish their citizens by inflating their currencies. And the very existence of DeFi force banking to be more open, free, and fair.

Note - if we included BTC in DeFi, it would be higher than 1-2%. But here I am talking about more traditional DeFi - Uniswap, Morpho, Aave, etc.

TradFi’s Horny Fixation on RWAs: Open Finance Is the Real Kink

TradFi (i.e. Wall Street) has always hated Bitcoin and DeFi.

Then they realized they could co-opt the technology, since it’s all open source, and use it for their own good!

This has manifested itself in the terminology of Real World Assets (RWAs). EVERYWHERE you look people are talking about RWAs. The name is dumb, it implies crypto assets are fake. DeFi is also not an appropriate name - as described above it is limited to 1-2% of global assets.

We need to adopt the name Open Finance. It better represents the rebuilding of the entire global financial system from fragmented and siloed to connected and open. It is similar to the upgrade from landlines to cell phones, a complete change in the underlying tech. Financial services will become efficient, cheap, and abundant.

The entire financial system will run on public, private, and permissioned blockchains. Some quick examples:

Payments → Stablecoins (USDT, USDC, USDS, USDe)

Forex → Stablecoins

Stock trading → Uniswap

Derivatives → Hyperliquid

Lending → Morpho

Treasuries → Ondo, Securitize

etc. etc.

And as we will see in 2025, the next instalment of exciting things for crypto VCs to dump billions into are OpenFi Chains.

OpenFi Chains

The RWA big dawgs are already launching their own chains. We got Ondo Chain, and Converge (Ethena And Securitize partnership). They are similar, each bringing the following:

Institutional grade RWAs on chain. The problem with public blockchains is there are no user protections. Users can be front ran and lose money to MEV, and they can be hacked, and lose their assets completely. OpenFi chains fix this.

Permissioned validators post the oracle prices of assets, removing reliance on external oracles.

KYC’d accounts for most assets, which should prevent against hacking.

Paying for gas fees in RWAs, such as stablecoins. Which is a much better user experience compared to paying in BTC, ETH, or SOL.

Big-league partnerships with TradFi firms and their liquidity.

Get ready, cuz these things are going to be shoved down your throat. But to be honest I welcome it. If it means I never have to deal with customer service at a bank again, I am happy. And they will have a symbiotic relationship with DeFi protocols. These banks will deposit in DeFi protocols like Sky / MakerDAO, driving up the assets in DeFi protocol.

How long until Mass Adoption of OpenFi?

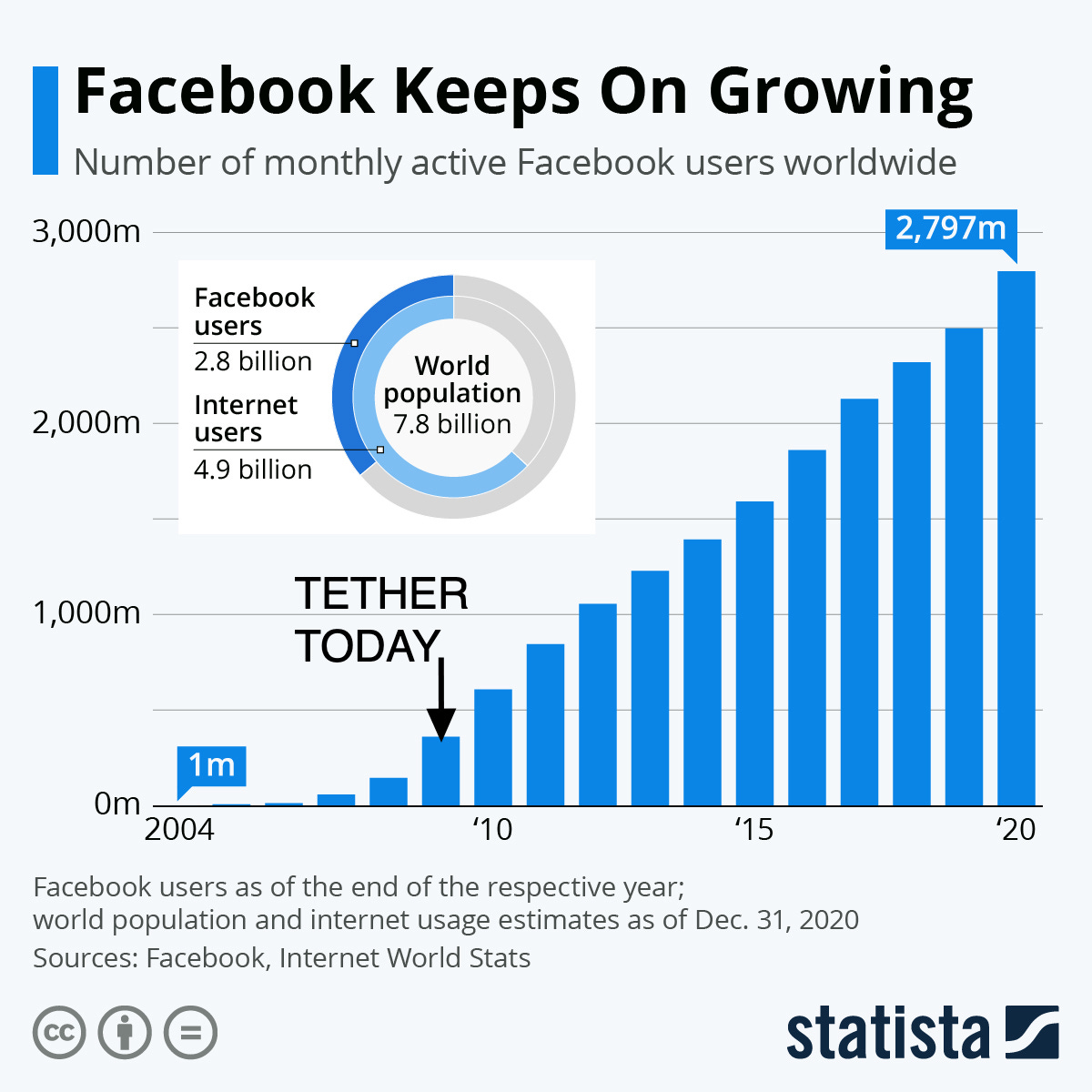

On a podcast with Castle Island Ventures, Tether CEO Paulo Ardoino mentioned there are ~400 million USDT users across the globe.

Comparing it to early adoption of social media, this would put Tether where Facebook was in 2009. In 2025 Facebook has passed 3 billion users.

So in another ~15 years, we could see 3 billion people participating in Open Finance. If anything it will happen faster as the internet is more connected, and the global population is growing.

OKAY, SO WHAT NOW?

Worldwide, there are trillions in revenue generated from financial services. All of this is going to be disrupted. Everything will be tokenized, stocks will be on chain, loans, whatever you want.

How can you position yourself? There are three tracks that crypto companies can go down:

You commit to being a fully decentralized protocol, and understand that you will never compete with the big banks, or centralized crypto exchanges. However, you can bask in the glory of the cypherpunks who will worship you.

You build a decentralized product that you maintain, and then an OpenFi product that you can attract the average banking user who doesn’t want to self custody their assets. We are already seeing this with Horizon by Aave, or Morpho’s partnership with Coinbase.

Just build in Open Finance. Don’t have any decentralization, but use free and open source blockchain tech to build connected financial databases. Basically, what the big US banks are going to try to do, and what Ondo Chain is.

Pick your poison, whether you’re a builder or an investor, or someone who’s just fed up with their bank.

And every time you have to deal with your clueless, inept bank, and have your soul sucked by their customer service, remind yourself that in 15 years, retail banking as we know it today, will be dead and gone!